550 East Swedesford Road, Suite 400

Wayne, Pennsylvania 19087

Notice of Annual Meeting of Stockholders

To Be Held on April 30, 2021May 5, 2023

March 26, 202131, 2023

TO THE STOCKHOLDERS OF TELEFLEX INCORPORATED:

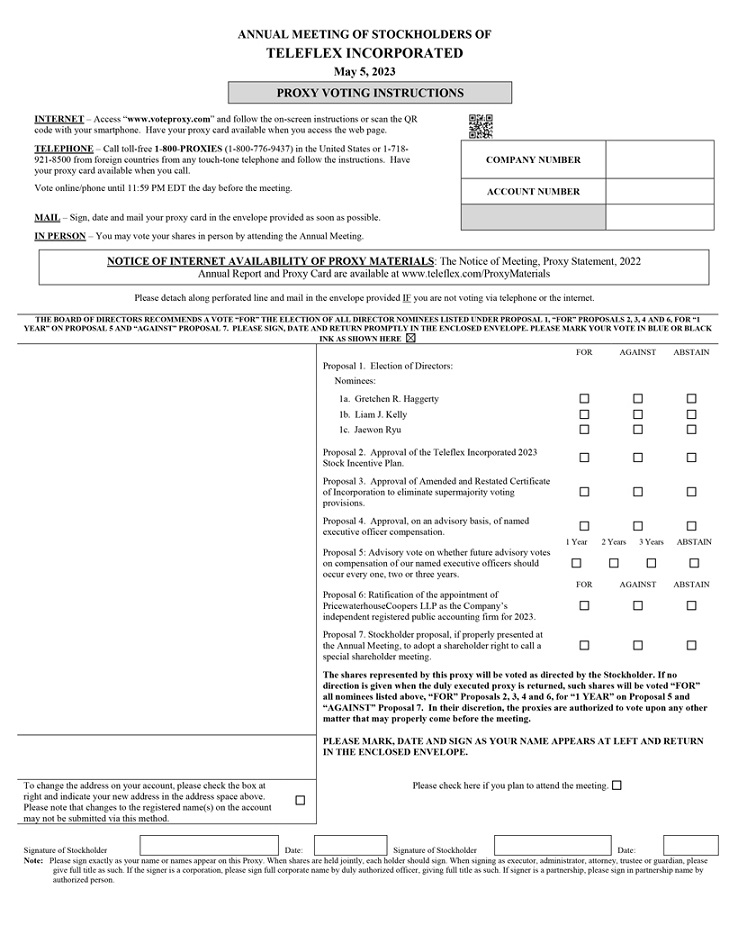

The annual meeting of stockholders (the “Annual Meeting”) of Teleflex Incorporated will be held on Friday, April May 5, 2023 at 12:30 2021 at 11:00 a.m.p.m., local time, at the Company’s headquarters, located at 550 East Swedesford Road, Wayne, Pennsylvania 19087, for the following purposes:

1. To elect three directors to serve on our Board of Directors for a term of three yearsone year and until their successors have been duly elected and qualified;

2. To vote upon a proposal to approve the Teleflex Incorporated 2023 Stock Incentive Plan;

3. To vote upon a proposal to amend our certificate of incorporation to eliminate supermajority voting provisions;

4. To vote upon a proposal to approve, on an advisory basis, the compensation of our named executive officers;

3.5. To hold an advisory vote on whether future advisory votes on the compensation of our named executive officers should be held every one, two or three years;

6. To vote upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021;2023;

4.7. To vote upon a stockholder proposal, to declassify our Board of Directors, if properly presented at the Annual Meeting; and

5.8. To transact such other business as may properly come before the meeting.

Our Board of Directors has fixed Friday, March 5, 20213, 2023 as the record date for the Annual Meeting. This means that owners of our common stock at the close of business on that date are entitled to receive notice of, and to vote at, the Annual Meeting.

We intend to hold the Annual Meeting in person. However, as part of our precautions regarding the ongoing COVID-19 pandemic, we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event it is not possible or advisable for stockholders to attend the Annual Meeting in person, we will announce in advance via press release alternative arrangements for the meeting, which may include providing a webcast of the Annual Meeting. The press release, which will include details on how to access the meeting, will be posted on our website and filed with the SEC as additional proxy materials. If you are planning to participate in the Annual Meeting, please check our website prior to the meeting date. As always, you are encouraged to vote your shares prior to the Annual Meeting.

Stockholders are requested to date, sign and return the enclosed proxy card in the enclosed envelope. No postage is necessary if mailed in the United States or Canada. You may also vote by telephone by calling toll free 1-800-PROXIES(776-9437), or via the internet at www.voteproxy.com.

| By Order of the Board of Directors, |

Daniel V. Logue |

Corporate Vice President, General Counsel and Secretary |

PLEASE VOTE — YOUR VOTE IS IMPORTANT

| Page | ||||

| 1 | ||||

| 2 | ||||

| 5 | ||||

Corporate Governance Principles and Other Corporate Governance Documents | ||||

| 13 | ||||

| 14 | ||||

| 21 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | |||

| 44 | ||||

| 47 | ||||

| ||||

| 54 | ||||

| 57 | ||||

| 59 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||

| 65 | ||||

PROPOSAL 3: AMENDMENT OF CERTIFICATE OF INCORPORATION TO ELIMINATE SUPERMAJORITY VOTING PROVISIONS | 76 | |||

PROPOSAL 4: ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | ||||

| 79 | ||||

TELEFLEX INCORPORATED

550 East Swedesford Road, Suite 400

Wayne, Pennsylvania 19087

PROXY STATEMENT

This proxy statement is furnished to stockholders in connection with the solicitation of proxies by the Board of Directors of Teleflex Incorporated (the “Company”(referred to as the “Company,” “Teleflex,” “we,” “us” or “Teleflex”“our”) for use at the Company’s annual meetingAnnual Meeting of stockholders (the “Annual Meeting”) to be held on Friday, April May 5, 2023 at 12:30 2021 at 11:00 a.m.p.m., local time, atthe Company’s headquarters, located at 550 East Swedesford Road, Wayne, Pennsylvania 19087. The proxies may also be voted at any adjournment or postponement of the Annual Meeting. Only stockholders of record at the close of business on March 5, 2021,3, 2023, the record date for the meeting, are entitled to vote. Each stockholder of record on the record date is entitled to one vote for each share of common stock held. On the record date, the Company had 46,747,75846,965,758 shares of common stock outstanding.

This proxy statement and the enclosed form of proxy are being mailed to stockholders on or about March 26, 2021.31, 2023. A copy of the Company’s 20202022 Annual Report is provided with this proxy statement.

The Company will pay the cost of solicitation of proxies. In addition to this mailing, proxies may be solicited, without extra compensation, by our officers and employees, by mail, telephone, facsimile, electronic mail and other methods of communication. The Company reimburses banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding solicitation materials to the beneficial owners of the Company’s common stock.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on April 30, 2021May 5, 2023

This proxy statement, the accompanying Notice of Annual Meeting, proxy card and

our 20202022 Annual Report are available at http://www.teleflex.com/ProxyMaterials.

| 1. | What is a “proxy”? |

It is your way of legally designating another person to vote for you. That other person is called a “proxy.” If you designate another person as your proxy in writing, the written document is called a “proxy” or “proxy card.”

| 2. | What is a “proxy statement”? |

It is a document required by the Securities and Exchange Commission (the “SEC”) that contains information about the matters that stockholders will vote upon at the Annual Meeting. The proxy statement also includes other information required by SEC regulations.

| 3. | What is a “quorum”? |

A quorum is the minimum number of stockholders who must be present at the Annual Meeting or voting by proxy to conduct business at the meeting. A majority of the outstanding shares of our common stock, whether present in person or represented by proxy, will constitute a quorum at the Annual Meeting.

| 4. | How many votes are required to elect director nominees and approve the proposals? |

To be elected at the meeting, a director nominee must receive the affirmative vote of a majority of the votes cast. For this purpose, a majority of the votes cast means that the number of votes cast in favor of a director nominee must exceed the number of votes cast against that director nominee. Abstentions and “broker non-votes” will have no effect on the vote.

Approval of each of the other proposals 2, 4, 5, 6 and 7 requires the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the proposal. Accordingly, abstentions have the same effect as votes against a proposal, while broker non-votes will not be included in the vote count and will have no effect on the vote.

Approval of proposal 3 requires the affirmative vote of the holders of at least 80% of the outstanding shares of the capital stock of the Company entitled to vote generally in the election of directors, considered for this purpose as one class. Abstentions and broker non-votes will have the same effect as a vote against each such proposal.

| 5. | What is a “broker non-vote”? |

A broker “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. Under New York Stock Exchange rules, brokers are not permitted to vote on the election of directors, the proposal to approve the Teleflex Incorporated 2023 Stock Incentive Plan, the advisory vote on executive compensation, the advisory vote on the frequency of future advisory votes on executive compensation, the proposal to amend our certificate of incorporation or the stockholder proposal to declassify our Board of Directors;proposal; therefore, if your shares are held by a broker, you must provide voting instructions if you want your broker to vote on these matters. Your broker or its designee should provide you with a voting instruction form for this purpose.

| 6. | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the stockholder of record, or a “record holder,” with respect to those shares, and you may submit a proxy card and vote those shares in the manner described in this proxy statement.

2

Most of our stockholders hold their shares as a beneficial owner through a broker, bank or other nominee rather than directly in their own name. If your shares are held through a broker, bank or other nominee, you are considered the “beneficial owner” of the shares. As the beneficial owner, you

generally have the right to direct your broker, bank or other nominee on how to vote your shares. Your broker, bank or other nominee should provide you with a voting instruction form that you use to give instructions as to how your shares are to be voted.

| 7. | How do I vote? |

If you were a record holder on the record date, you may vote through any of the following methods:

attend the Annual Meeting in person and submit a ballot,

sign and date each proxy card you receive and return it in the prepaid envelope included in your proxy package,

vote by telephone by calling 1-800-PROXIES(776-9437) or

| • | vote by telephone by calling 1-800-PROXIES(776-9437) or |

| • | vote via the internet at www.voteproxy.com. |

The shares represented by a proxy will be voted in accordance with the instructions you provide on the proxy card or that you submit via telephone or the internet, unless the proxy is revoked before it is exercised. Any proxy card which isIf no such instructions have been specified by marking the appropriate squares in the signed and returned but does not indicate voting instructionsproxy card, the shares will be treatedvoted by the persons named in the enclosed proxy card as authorizing a vote follows:

FOR the election of the director nominees described in this proxy statement, statement;

FOR the approval of the Teleflex Incorporated 2023 Stock Incentive Plan;

FOR the approval of the amendment of our certificate of incorporation to eliminate supermajority voting rights;

FOR the approval, on an advisory basis, of the compensation of our named executive officers;

for the approval, on an advisory basis, of holding future advisory votes on the compensation of our named executive officers every ONE year;

FOR the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 20212023; and ABSTAIN as to

AGAINST the stockholder proposal regarding board declassification.titled “Shareholder Right to Call a Special Shareholder Meeting.”

If you were a beneficial owner of shares at the close of business on the record date, you may vote your shares by providing instructions to your broker, bank or other nominee. Your broker, bank or other nominee should provide a voting instruction form that you can use to give instructions as to how your shares are to be voted; please refer to the instructions it provides for voting your shares. If you want to vote those shares in person at the Annual Meeting, you must bring a signed proxy from the broker, bank or other holder of record giving you the right to vote the shares.

| 8. | What should I do if I receive more than one proxy card? |

If you hold shares registered in more than one account, you may receive more than one copy of the proxy materials, including multiple paper copies of this proxy statement and multiple proxy cards. To vote all of your shares by proxy, you must complete, sign, date and return each proxy card that you receive or, if you submit a proxy by telephone or the internet, submit one proxy for each proxy card you receive.

| 9. | How can I revoke my proxy? |

You may revoke your proxy at any time before the proxy is exercised by delivering a signed statement indicating your revocation to our Corporate Secretary at our principal executive offices at

3

550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087 at or prior to the Annual Meeting. Alternatively, you may revoke your proxy by timely executing and delivering, by internet, telephone, mail, or in person at the Annual Meeting, another proxy dated as of a later date. You also may revoke your proxy by attending the Annual Meeting in person and voting by ballot. Attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

If your shares are held by a broker, bank or other nominee, contact that institution for instructions.

| 10. | Who can attend the Annual Meeting? |

Any Company stockholder as of the close of business on March 5, 20213, 2023 may attend the Annual Meeting. You will need proof of ownership to enter the meeting. If your shares are held in street name (beneficially held in the name of a broker, bank or other holder of record), you must present proof of your ownership, such as a bank or brokerage account statement, to be admitted to the meeting. Please note that if you are a beneficial holder and would like to vote at the meeting in person, you will need to bring a legal proxy from your broker, bank or other holder of record. Stockholders must also present a valid form of photo identification, such as a driver’s license, in order to be admitted to the meeting.

In light of the ongoing COVID-19 pandemic, the Annual Meeting will be conducted in compliance with limitations on public gatherings mandated by federal, state and local authorities and other preventive measures recommended by public health experts. These measures are expected to include conducting health screenings for all attendees prior to admission to the meeting, enforcing optimal social distancing guidelines for all attendees and requiring all attendees to wear masks. Health screening prior to admission to the Annual Meeting are expected to include a temperature scan and completion of a questionnaire concerning potential exposure to COVID-19 and the presence, or absence, of symptoms associated with COVID-19. Any individual who refuses to complete a questionnaire, wear a mask or submit to screening or who answers a screening question affirmatively or displays any symptoms that could be related to COVID-19 will not be permitted to attend the Annual Meeting in person.

Even if you plan to attend the meeting in person, you are strongly encouraged to vote your shares by submitting a proxy.

|

As part of our precautions regarding the ongoing COVID-19 pandemic, we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event it is not possible or advisable for stockholders to attend our annual meeting in person, we will announce in advance via press release alternative arrangements for the meeting, which may include providing a webcast of the annual meeting. The press release, which will include details on how to access the meeting, will be posted on our website and filed with the SEC as additional proxy materials. If you are planning to participate in the Annual Meeting, please check our website prior to the meeting date. As always, you are encouraged to vote your shares prior to the Annual Meeting.4

ELECTION OF DIRECTORS

Prior to our annual meeting of stockholders held on April 29, 2022 (the “2022 Annual Meeting”), our certificate of incorporation and bylaws provided for a classified board of directors consisting of three classes of directors with staggered terms, with each class elected for a term of three years to succeed those directors whose terms expired at the annual meeting date. At our 2022 Annual Meeting, our stockholders approved an amendment to our certificate of incorporation to phase out our classified board commencing with the Annual Meeting, which was filed with the Secretary of State of Delaware on May 2, 2022. Our Board also amended our bylaws to make corresponding modifications. In accordance with our amended and restated certificate of Directors (the “Board”) currently consistsincorporation and bylaws, each director elected at each annual meeting of nine members divided into three classes,stockholders commencing with one class being elected each yearthe Annual Meeting will hold office for a three-year term. term of one year, expiring at the next annual meeting of stockholders and until his or her respective successor is duly elected and qualified, unless he or she dies, resigns, retires or is removed from office prior to such time.

George Babich, Jr., who is in the director class having a term that expires at the Annual Meeting, has reached the mandatory retirement age under our Corporate Governance Principles and will leave the Board upon the expiration of his term at the Annual Meeting. The Board extends its gratitude to Mr. Babich for his contributions to our company during his tenure on the Board.

At the Annual Meeting, three directors will be elected for terms expiring at our annual meetingAnnual Meeting of stockholders in 2024 and uponor until their successors beingare duly elected and qualified. The Board, upon the recommendation of the Nominating and Governance Committee, has nominated Candace H. Duncan, Stephen K. Klasko, M.D.Gretchen R. Haggerty, Liam J. Kelly and Stuart A. RandleJaewon Ryu for election to the Board for three-yearone-year terms. Ms. Duncan, Dr. KlaskoHaggerty and Mr. RandleKelly are continuing directors who previously were elected by our stockholders. Mr. Ryu is a new nominee who, if elected, will fill the vacancy created as a result of Mr. Babich’s retirement.

Our bylaws generally require that, in order to be elected in an uncontested election of directors, a director nominee must receive a majority of the votes cast with respect to that director nominee’s election (for this purpose, a majority of the votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee). If a nominee who is currently serving as a director is not re-elected, Delaware law provides that the director will continue to serve on the board of directors. However, under our Corporate Governance Principles, the Board will not nominate for election as a director any incumbent director unless the director has submitted in writing his or her irrevocable resignation, which would be effective if the director does not receive the required majority vote and the Board accepts the resignation. Generally, if an incumbent director does not receive the required majority vote, our Nominating and Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether to take other action. The Board would act on the resignation, generally within 90 days from the date that the election results are certified. The Board’s decision and an explanation of any determination with respect to the director’s resignation will be disclosed promptly in a current report on Form 8-K filed with the SEC.

We seek to assemble a Board that operates cohesively and works with management in a constructive way so as to deliver long term stockholder value. In addition, the Board believes it operates best when its membership reflects a diverse range of experiences, areas of expertise and backgrounds. To this end, the Board seeks to identify candidates whose respective experience expands or complements the Board’s existing expertise in overseeing our company. Our Corporate Governance Principles provide that directors are expected to possess the highest character and integrity and to have business, professional, academic, government or other experience which is relevant to our business and operations. However, there is no set list of qualities or areas of expertise used by the Board in its analysis because it assesses the attributes each particular candidate could bring to the Board in light of the then-current composition of the Board. In evaluating nominees for election to the Board, consistent with our Corporate Governance Principles, our Nominating and

5

Governance Committee considers, among other factors, the candidate’s potential to contribute to the diversity of the Board, including with respect to gender, race, ethnicity, national origin and other differentiating characteristics. Currently, 22% of the directors on our Board are women. While we currently do not have any directors who self-identify as racially or ethnically diverse, in connection with its succession planning efforts and in addition to certain specified criteria related to business experience and areas of expertise, our Board has determined to prioritize the inclusion of racially and ethnically diverse candidates as part of the pool of potential director nominees to be considered

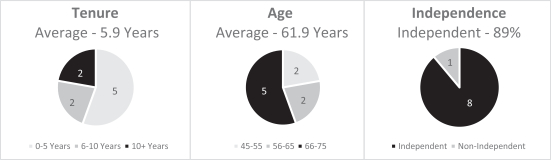

The following charts provide information with respect to the next director to be added totenure, age, independence and diversity of our Board.nominees and continuing directors.

| Board Diversity Matrix | ||||

| Total Director Nominees and Continuing Directors | 9 | |||

| Female | Male | |||

| Gender Identity | ||||

| Directors | 3 | 6 | ||

| Demographic Background | ||||

| African American or Black | – | – | ||

| Alaskan Native or Native American | – | – | ||

| Asian | 1 | 1 | ||

| Hispanic, Latinx or Spanish Origin | – | – | ||

| Native Hawaiian or Pacific Islander | – | – | ||

| White | 2 | 5 | ||

| Other | – | – | ||

| Two or More Races or Ethnicities | – | – | ||

| LGBTQ+ | – | – | ||

| Did not Disclose Demographic Background | – | – | ||

We believe our current directors possess valuable experience in a variety of areas, which enables them to guide Teleflex in the best interests of the stockholders. Information regarding each of our nominees and continuing directors is set forth below.

Nominees for election to the Board of Directors –

| Gretchen R. Haggerty | - | Ms. Haggerty, 67, has been a director of Teleflex since 2016 and currently serves as a member of the Audit Committee. Ms. Haggerty retired in August 2013 after a 37-year career with United States Steel Corporation, an integrated global steel producer, and its predecessor, USX Corporation, which, in addition to its steel production, also conducted energy operations, principally through Marathon Oil Corporation. From March 2003 until her retirement, she served as Executive Vice President & Chief Financial Officer and also served as Chairman of the U. S. Steel & |

6

Carnegie Pension Fund and its Investment Committee. Earlier, she served in various financial executive positions at U.S. Steel and USX, beginning in November 1991 when she became Vice President & Treasurer. Ms. Haggerty is currently a director of Johnson Controls International plc. Ms. Haggerty’s background in executive management of a large, complex global corporation, as well as her experience gained through other public company directorships, enables her to share valuable perspectives with the Board on a wide range of financial and business matters. Her lengthy tenure as a financial executive renders her well-qualified to assist the Board with a variety of financial and budgeting matters, and in its oversight of our financial statements and internal controls. | ||||||

| Liam J. Kelly | - | Mr. Kelly, 56, has been a director of Teleflex since 2018 and has served as Chairman of our Board since May 2020. He became our President and Chief Executive Officer in January 2018. From May 2016 to December 2017, Mr. Kelly served as our President and Chief Operating Officer, and from April 2015 to April 2016, he served as our Executive Vice President and Chief Operating Officer. Mr. Kelly also served as our Executive Vice President and President, Americas from April 2014 to April 2015, and as our Executive Vice President and President, International from June 2012 to April 2014. Earlier, he held several positions with regard to our EMEA segment, including President from June 2011 to June 2012, Executive Vice President from November 2009 to June 2011, and Vice President of Marketing from April 2009 to November 2009. Prior to joining Teleflex, Mr. Kelly held various senior level positions with Hill-Rom Holdings, Inc., a medical device company, from October 2002 to April 2009, serving as its Vice President of International Marketing and R&D from August 2006 to February 2009. Mr. Kelly is currently a director of Enovis Corporation (formerly Colfax Corporation). Mr. Kelly’s extensive experience in the medical device industry and intimate knowledge of our business enable him to provide meaningful perspectives regarding our operations, strategic planning and growth initiatives. In addition, Mr. Kelly, who was born in Ireland, has extensive experience managing international businesses, enabling him to provide valuable insights regarding international markets and our businesses and operations outside the U.S. | ||||

| Jaewon Ryu, M.D. | - | Dr. Ryu, 49, is a new director nominee. Since June 2019, Dr. Ryu has been the President and Chief Executive Officer of Geisinger, an integrated healthcare system with a clinical enterprise, health plan, a school of medicine and research and innovation functions. He joined Geisinger in October 2016 and served as Executive Vice President and Chief Medical Officer until December 2018. From December 2018 to June 2019, he served as Interim President and Chief Executive Officer of Geisinger. Prior to joining Geisinger, Dr. Ryu served as President, Integrated Care Delivery for Humana, Inc., a health insurance company, from January 2014 to September 2016. Previously, he served in various leadership capacities at the University of Illinois Hospital and Health Sciences System and Kaiser Permanente, after having practiced as a corporate healthcare attorney and worked in government roles at the Centers for Medicare and Medicaid Services |

7

and the Department of Veterans Affairs. Dr. Ryu is currently a director of Privia Health Group, Inc. Dr. Ryu’s extensive experience in the areas of care delivery and payment will enable him to provide meaningful perspectives with respect to a wide range of business matters, including with respect to our strategic initiatives. His knowledge and background in legal and regulatory aspects of the healthcare industry and government policy will enable him to provide valuable industry insights. |

In the unlikely event that any nominee becomes unable or unwilling to stand for election, the proxies may be voted for one or more substitute nominees designated by the Board, or the Board may decide to reduce the number of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

The following individuals currently serve as directors in the two other classes. Their terms will end at the Annual Meetings in 2024 and 2025, respectively.

Terms Expiring in 2024

| Candace H. Duncan | - | Ms. Duncan,

Ms. Duncan’s extensive experience in public accounting enables her to provide

| ||||

| Stephen K. Klasko, M.D. | - | Dr. Klasko, |

8

Dr. Klasko’s background in medicine and business enables him to provide valuable insights with regard to our strategic and growth initiatives. His background in medicine enables him to provide a unique and practical perspective regarding the application and marketing of our medical device products, as well as trends in global healthcare markets.

| ||||||

| Stuart A. Randle | - | Mr. Randle, |

International Inc. Mr. Randle currently serves as a director of Beacon Roofing Supply, Inc. and Comera Life Sciences Holdings, Inc.

Mr. Randle’s medical device company experience, coupled with past senior management positions at medical device companies, enables him to provide valuable insights regarding a variety of business, management and technical issues. |

In the unlikely event that any nominee becomes unable or unwilling to stand for election, the proxies may be voted for one or more substitute nominees designated by the Board, or the Board may decide to reduce the number of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

The following individuals currently serve as directors in the two other classes. Their terms will end at the Annual Meetings in 2022 and 2023, respectively.

Terms Expiring in 20222025

| John C. Heinmiller | - | Mr. Heinmiller,

Mr. Heinmiller’s executive and senior management experience in the medical device industry

|

9

| Andrew A. Krakauer | - | Mr. Krakauer, |

Operating Officer from August 2004 through April 2008. Mr. Krakauer also served as a member of Cantel’s board of directors from 2009 to 2016. Prior to joining Cantel, Mr. Krakauer was President of the Ohmeda Medical Division of Instrumentarium Corp. (which was acquired by General Electric Company in 2003), a provider of medical devices, from 1998 to 2004.

Mr. Krakauer’s executive and senior management experience in the medical device industry enables him to provide valuable insights regarding a wide range of business matters, including strategy, acquisitions, management, operations and growth

| ||||||

| Neena M. Patil | - |

|

Terms Expiring in 2023

| ||||||

|

Ms. Haggerty’s background in executive management of a large, complex global corporation, as well as her experience gained through other public company directorships, enables her to share valuable perspectives with the Board on a wide range of financial and business matters. Her lengthy tenure as a financial executive renders her well-qualified to assist the Board with a variety of financial and budgeting matters, and in its oversight of our financial statements and internal controls.

Mr. Kelly, 54, has been a director of Teleflex since 2018 and has served as Chairman of our Board since May 2020. He became our President and Chief Executive Officer in January 2018. From May 2016 to December 2017, Mr. Kelly served as our President and Chief Operating Officer, and from April 2015 to April 2016, he served as our Executive Vice President and Chief Operating Officer. Mr. Kelly also served as our Executive Vice President and President, Americas from April 2014 to April 2015, and as our Executive Vice President and President, International from June 2012 to April 2014. Earlier, he held several positions with regard to our EMEA segment, including President from June 2011 to June 2012, Executive Vice President from November 2009 to June 2011, and Vice President of Marketing from April 2009 to November 2009. Prior to joining Teleflex, Mr. Kelly held various senior level positions with Hill-Rom Holdings, Inc., a medical device company, from October 2002 to April 2009, serving as its Vice President of International Marketing and R&D from August 2006 to February 2009. Mr. Kelly is currently a director of Colfax Corporation.

Mr. Kelly’s extensive experience in the medical device industry and intimate knowledge of our business enables him to provide meaningful perspectives regarding our operations, strategic planning and growth initiatives.

Corporate Governance Principles and Other Corporate Governance Documents

Our Corporate Governance Principles, which include guidelines for the determination of director independence, the operation, structure and meetings of the Board and the committees of the Board and other matters relating to our corporate governance, are available on the Investors page of our website, www.teleflex.com. Also available on the Investors page are other corporate governance documents, including the Code of Ethics, the Code of Ethics for Chief Executive Officer and Senior Financial Officers and the charters of the Audit, Compensation and Nominating and Governance Committees. You may request these documents in print form by contacting us at Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Secretary. Any amendments to, or waivers of, the codes of ethics that apply to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar function and that relate to any element of the code of ethics definition enumerated in Item 406(b) of the SEC’s Regulation S-K will be disclosed on our website promptly following the date of such amendment or waiver.

The Board has affirmatively determined that George Babich, Jr., Candace H. Duncan, Gretchen R. Haggerty, John C. Heinmiller, Stephen K. Klasko, Andrew A. Krakauer, Richard A. PackerNeena M. Patil and Stuart A. Randle are independent within the meaning of the listing standards of the New York Stock Exchange (the “NYSE”). The Board also has determined that Jaewon Ryu, a nominee who is not currently a director, is independent within the meaning of the NYSE listing standards. All of the independent directors and Dr. Ryu meet the categorical standards set forth in the Corporate Governance Principles described below, which were adopted by the Board to assist it in making determinations of independence. The Board has further determined that the members of the Audit, Compensation and Nominating and Governance Committees are independent within the meaning of the NYSE listing standards, and that the members of the Audit and Compensation Committees meet the additional independence requirements of the NYSE and the SEC applicable to audit committee and compensation committee members. In making its determination with respect to Dr. Klasko, the Board considered the Company’s sale of products to an entity for which he serves as chief executive officer. In making its determination with respect to Mr. Packer, the Board considered the Company’s sale of products to an entity for which he serves as non-executive Chairman. In making its determination with regard to Mr. Heinmiller, the Board considered the Company’s sale of products to an entitya hospital system with respect to which he serves as a member of the board of directors. In making its determination with respect to Dr. Ryu, the Board considered the Company’s sale of products to a hospital system for which he serves as a director.President and Chief Executive Officer. Based on its review, and after considering the amounts involved and the lack of Dr. Klasko’s, Mr. Packer’s or Mr. Heinmiller’s or Dr. Ryu’s direct or indirect involvement in the respective transactions, the Board concluded that Dr. Klasko’s, Mr. Packer’s and Mr. Heinmiller’s and Dr. Ryu’s relationships with the respective entitieshospital systems did not impair their independence.

To assist the Board in making independence determinations, the Board has adopted the following categorical standards that, if applicable, automatically would result in a determination that the director is not independent. The Board may determine that a director is not independent notwithstanding that none of the following categorical disqualifications apply. However, if any of the following categorical disqualifications apply to a director, he or she may not be considered independent:

A director who is an employee of our company, or whose immediate family member is an executive officer of our company, may not be considered independent until the expiration of three years after the end of such employment.

A director who has received, or who has an immediate family member (unless such immediate family member has ceased to be an immediate family member or has become incapacitated) that has been an executive officer of ours who, while an executive officer, has received more than $120,000 in direct compensation from us during any twelve-month period during the preceding three years, other than director and committee fees, pension or

11

period during the preceding three years, other than director and committee fees, pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service) and compensation received by the director for former service as an interim Chairman or CEO may not be considered independent. |

A director who is a current partner or is employed by, or whose immediate family member is a current partner of a firm that is our internal or external auditor, or is an immediate family member who is a current employee of such a firm and personally works on the Company’s audit, may not be considered independent.

A director who was, or whose immediate family member was, during the immediately preceding three years, a partner or employee of a firm that is our internal or external auditor and personally worked on our audit during that period may not be considered independent.

A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executives serve on such other company’s compensation committee may not be considered independent until the expiration of three years after the end of such service or employment relationship or such person ceases to be an immediate family member or becomes incapacitated, as may be applicable.

A director who is an employee, or whose immediate family member is an executive officer, of a company that makes payments to us, or receives payments from us, for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues may not be considered independent until the expiration of the three years after such receipts or payments fall below such threshold or after such person ceases to be an immediate family member or becomes incapacitated, as may be applicable.

The Lead Director is an independent director of the Board whose authority, duties and responsibilities include:

coordinating and developing the agenda for, and presiding over, executive sessions of the Board’s independent directors;

ability to call meetings of the independent directors;

discussing with our directors any concerns our directors may have about our company and our performance, relaying those concerns, where appropriate, to the full Board, and consulting with our Chief Executive Officer regarding those concerns;

providing our Chief Executive Officer with feedback regarding matters discussed by the independent directors in executive sessions;

consulting with our senior executives as to any concerns they may have;

together with the Chairman of the Board, develop and approve Board meeting agendas, and provide input to committee chairs on committee meeting agendas;

advising the Chairman of the Board as to the quality, quantity and timeliness of the flow of information from our management to the Board that is necessary for the independent directors to effectively and responsibly perform their duties; the Lead Director may ask company management to include certain material in the information provided to the Board;

interviewing, along with the Nominating and Governance Committee Chair, and making recommendations to the Nominating and Governance Committee and the Board concerning Board candidates;

providing input to the members of the Compensation Committee regarding the Chief Executive Officer’s performance, and, along with the Compensation Committee Chair, meeting with the Chief Executive Officer to discuss the Board’s evaluation; and

if requested, consult and directly communicate with shareholders, government authorities and other interested parties on behalf of the independent directors.

The Lead Director is appointed annually by the independent directors of the Board. The independent directors of the Board have the authority to modify the Lead Director’s duties and responsibilities, remove the Lead Director and appoint a successor. Mr. Babich currently serves as our Lead Director. In February 2023, the Board appointed Dr. Klasko to succeed Mr. Babich as Lead Director, effective upon Mr. Babich’s retirement from the Board.

The Board’s goal is to achieve the best board leadership structure for effective oversight and management of our company. The Board believes there is no single, generally accepted approach to providing effective board leadership, and that the leadership structure of a board must be considered in the context of the individuals involved and the specific circumstances facing the company. Accordingly, what the Board determines to be the right board leadership structure for Teleflex may vary from time to time as circumstances warrant.

The Board appointed Mr. Kelly to succeed Mr. Benson Smith as Chairman, effective May 2020. In making its decision to appoint Mr. Kelly as Chairman, our Board determined that, in his role as our President and Chief Executive Officer, Mr. Kelly is the director most familiar with our business and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Moreover, Mr. Kelly is able to effectively communicate Board strategy to the other members of management and efficiently implement Board directives.

All of the other directors on our Board are independent, which facilitates the provision of independent oversight and input. Mr. Kelly is not a member of our principal Board committees, and the independent directors regularly meet in executive session outside the presence of management and under the leadership of our Lead Director, as discussed in more detail below under “Executive Sessions of Non-Management Directors.” The activities of the Lead Director further enhance the Board’s ability to evaluate management performance and otherwise fulfill its oversight responsibilities. Moreover, the Lead Director is consulted on the proposed agendas for Board and committee meetings in order to make sure that key issues and concerns of the Board are addressed.

Executive Sessions of Non-Management Directors

Directors who are not executive officers or otherwise employed by us or any of our subsidiaries, whom we refer to as the “non-management directors,” meet regularly in accordance with a schedule adopted at the beginning of each year and on such additional occasions as any non-management director may request. Such meetings are held in executive session, outside the presence of any directors who are executive officers. The Lead Director presides over such meetings.

Communicating with Our Board

Stockholders or other interested persons wishing to communicate with members of the Board should send such communications to Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Secretary. These communications will be forwarded to specified individual directors, or, if applicable, to all the members of the Board as deemed appropriate. Stockholders or other interested persons may also communicate directly and confidentially with the Lead Director, the non-management directors as a group or the Chairman or other members of the Audit Committee through the Teleflex ethics line website at www.teleflexethicsline.com.

Each year, the Nominating and Governance Committee of the Board, together with the Lead Director, oversees a self-assessment process to evaluate the performance of the Board and its committees. The evaluations also help to inform the Nominating and Governance Committee’s discussions regarding Board succession planning and refreshment and complement its evaluation of the size and composition of the Board. The process for conducting the annual assessment varies from year to year, but is generally conducted through interviews, discussions and/or responses to written questionnaires. The results are then compiled and reviewed in detail and discussed by the Board and each committee, as applicable. The Board believes that the evaluation process is an important tool for improvement and the continued effectiveness of the Board and its committees.

The Board and Board Committees

The Board held sixeight meetings in 2020.2022. Each of the directors attended at least 75 percent of the total number of meetings of the Board and the Board committees of which the director was a member during 2020.2022. The Board does not have a formal policy concerning attendance at our annual meetingAnnual Meeting of stockholders, but encourages all directors to attend. All of our Board members attended the 2020 annual meeting2022 Annual Meeting of stockholders.

The Board has established a Nominating and Governance Committee, a Compensation Committee and an Audit Committee. The Board also has established a Non-Executive Equity Awards Committee, whose sole member is Mr. Kelly. The Non-Executive Equity Awards Committee has authority to grant equity awards, under specified circumstances, to employees who are neither executive officers nor persons reporting to the Chief Executive Officer. See “Compensation Discussion and Analysis – 20202022 Compensation – Our Equity Grant Practices” for additional information.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for identifying qualified individuals to be nominees for election to the Board. In addition, the Nominating and Governance Committee reviews and makes recommendations to the Board as to the size and composition of the Board and Board committees, eligibility criteria for Board and Board committee membership and board compensation. The Nominating and Governance Committee also is responsible for developing and recommending to the Board corporate governance principles, overseeing the annual Board and committee evaluation process, as discussed above, and overseeing the evaluation of the Board.our strategy and practices with respect to environmental, social and governance matters.

The Nominating and Governance Committee considers candidates for Board membership. Our Corporate Governance Principles provide that directors are expected to possess the highest character and integrity, and to have business, professional, academic, government or other experience which is relevant to our business and operations. In addition, we also seek candidates with the potential to contribute to the diversity of the Board, including with respect to gender, race, ethnicity, national origin and other differentiating characteristics. Directors must be able to devote substantial time to our affairs. The charter of the Nominating and Governance Committee provides that in evaluating nominees, the Nominating and Governance Committee should consider the attributes set forth above.

To assist in identifying candidates for nomination as directors, the Nominating and Governance Committee sometimes employs a third-party search firm and also receives recommendations of candidates from Board members. In addition, the Nominating and Governance Committee will consider recommendations for director candidates from stockholders. Dr. Ryu was recommended by a third-party search firm.

In addition, Stockholders can recommend candidates for nomination by delivering or mailing written recommendations to Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne,

14

Pennsylvania 19087, Attention: Secretary. In order to enable consideration of a candidate in connection with our 20222024 Annual Meeting, a stockholder must submit the following information by January 30, 2022:February 5, 2024:

the name of the candidate and information about the candidate that would be required to be included in a proxy statement under SEC rules;

information about the relationship between the candidate and the recommending stockholder;

the consent of the candidate to serve as a director; and

proof of the number of shares of our common stock that the recommending stockholder owns and the length of time the shares have been owned.

We have also adopted a “proxy access” bylaw provision which allows eligible stockholders to nominate candidates for election to our Board and include such candidates in our proxy statement and proxy card subject to the terms, conditions, procedures and deadlines set forth in Article II, Section 2.2.2 of our bylaws. Our proxy access bylaw provides that holders of at least 3% of our

outstanding shares, held by up to 20 stockholders, holding the shares continuously for at least three years, can nominate up to the greater of two directors or 20% of our Board for election at an annual stockholders’ meeting.

For more specific information regarding these deadlines in respect of the 2022 annual meeting2024 Annual Meeting of stockholders, see “Stockholder Proposals” below. You should consult our bylaws for more detailed information regarding the processes summarized above.

In considering any candidate proposed by a stockholder, the Nominating and Governance Committee will reach a conclusion based on the criteria described above. The Nominating and Governance Committee may seek additional information regarding the candidate. After full consideration, the stockholder proponent will be notified of the decision of the Nominating and Governance Committee. The Nominating and Governance Committee will consider all potential candidates in the same manner regardless of the source of the recommendation.

The current members of the Nominating and Governance Committee are Dr. Klasko, Mr. Randle and Messrs. Packer and Randle.Ms. Patil. Mr. Randle currently serves as chair of the Nominating and Governance Committee. The Nominating and Governance Committee held four meetings in 2020.2022.

Compensation Committee

The duties and responsibilities of the Compensation Committee include, among others, the following:

review and recommend to the Board for approval all compensation plans in which any director or executive officer may participate;

review and recommend to the independent directors for approval corporate goals and objectives relevant to the compensation of our Chief Executive Officer and, together with the Lead Director, evaluate annually our Chief Executive Officer’s performance in light of those goals and objectives;

review and recommend to the independent directors for approval our Chief Executive Officer’s compensation and any employment agreements, severance agreements, retention agreements, change in control agreements and other similar agreements for the benefit of our Chief Executive Officer;

review and approve compensation of our senior executives, which include our executive officers (other than our Chief Executive Officer) and such other executives of our company as the Compensation Committee may determine (other than our Chief Executive Officer), and any employment agreements, severance agreements, retention agreements, change in control agreements and other similar agreements for the benefit of any of our senior executives (other than our Chief Executive Officer);

15

as the Compensation Committee may determine (other than our Chief Executive Officer), and any employment agreements, severance agreements, retention agreements, change in control agreements and other similar agreements for the benefit of any of our senior executives (other than our Chief Executive Officer); |

establish goals for performance-based awards under incentive compensation plans (including stock compensation plans);

administer and grant, or recommend to the Board the grant of, stock options and other equity-based compensation awards under our stock compensation plans (the Board has delegated to its Non-Executive Equity Awards Committee, whose sole member is Mr. Kelly, authority to grant equity awards under specified circumstances to employees other than executive officers and persons reporting to the Chief Executive Officer);

| • | administer and grant, or recommend to the Board the grant of, stock options and other equity-based compensation awards under our stock compensation plans (the Board has delegated to its Non-Executive Equity Awards Committee, whose sole member is Mr. Kelly, authority to grant equity awards under specified circumstances to employees other than executive officers and persons reporting to the Chief Executive Officer); |

review and recommend to the other independent directors for approval all material executive benefits and perquisites for the Chief Executive Officer’s benefit; and

review and approve all material executive benefits and perquisites for the benefit of any of our senior executives (other than the Chief Executive Officer).; and

review the human capital processes and performance metrics used by management to attract, retain and develop talent across our company.

The Compensation Committee has the authority to select, retain and terminate compensation consultants, legal counsel and other advisers to assist it in connection with the performance of its responsibilities. During 2020,2022, the Compensation Committee considered the recommendations of and data provided by its compensation consultant, Frederick W. Cook & Co., Inc. See “Compensation Discussion and Analysis” for additional information.

The current members of the Compensation Committee are Messrs. Babich, Krakauer and Randle. Mr. Babich currently serves as chair of the Compensation Committee. The Compensation Committee held fivesix meetings in 2020.2022.

Audit Committee

The Audit Committee has responsibility to assist the Board in its oversight of the following matters, among others:

the integrity of our financial statements;

our internal control compliance;

our compliance with legal and regulatory requirements;

our independent registered public accounting firm’s qualifications, performance and independence;

the performance of our internal audit function;

our risk management process;process, including risks related to product quality and safety and cybersecurity; and

the funding of our defined benefit pension plan and the investment performance of plan assets.

The Audit Committee has sole authority to appoint, retain, compensate, evaluate and terminate our independent registered public accounting firm, and reviews and approves in advance all audit and lawfully permitted non-audit services performed by the independent registered public accounting firm and related fees. For a discussion of the Audit Committee’s pre-approval policies and procedures, see

16

“Audit Committee Pre-Approval Procedures” included under Proposal 3 of this proxy statement. In addition, the Audit Committee periodically meets separately with management, our independent auditors and our own internal auditors. The Audit Committee also periodically discusses with management our policies with respect to risk assessment and risk management.

Stockholders and other persons may contact our Audit Committee to report complaints about our accounting, internal accounting controls or auditing matters by writing to the following address: Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Audit Committee. Stockholders and such other persons, including employees, can report their concerns to the Audit Committee anonymously or confidentially.

The current members of the Audit Committee are Mses. Duncan and Haggerty and Mr. Heinmiller. Ms. Duncan currently serves as chair of the Audit Committee. The Audit Committee held seveneight meetings in 2020.2022. The Board has determined that each of the Audit Committee members is an “audit committee financial expert” as that term is defined in SEC regulations.

The Board, acting principally through the Audit Committee, is actively involved in the oversight and management of risks that could affect us. It fulfills this function largely through its oversight of our annual company-wide risk assessment process, which is designed to identify our key strategic, operational, compliance and financial risks, as well as steps to mitigate and manage each risk. The risk assessment process is conducted by our compliance officer, who surveys and interviews several of our key business leaders, functional heads and other managers to identify and discuss the key risks

pertaining to Teleflex, including the potential magnitude of each risk and likelihood of occurrence of adverse consequences of such risk. As part of this process, the senior executive responsible for managing the risk, the potential impact of the risk and management’s initiatives to manage the risk are identified and discussed. After receiving a report of the risk assessment results from the compliance officer, members of Teleflex senior management review and discuss the results with the Audit Committee. Thereafter, the Audit Committee and our Chief Executive Officer provide the full Board with an overview of the risk assessment process, the key risks identified and measures being taken to address those risks. Due to the dynamic nature of risk, the overall status of our enterprise risks is updated periodically during the course of each year and reviewed with the Audit Committee. In addition, the Board, acting principally through the Audit Committee, provides oversight of our cybersecurity program. The Audit Committee reviews, on at least a semi-annual basis, our cybersecurity programs and cyber risks through in-depth reviews with management. We believe this process facilitatesthese processes facilitate the Board’s ability to fulfill its oversight responsibilities with respect to risks that we encounter.

The Compensation Committee oversees the review and assessment of our compensation policies and practices. We use a number of approaches to mitigate excessive risk taking in designing our compensation programs, including significant weighting towards long-term incentive compensation, inclusion of qualitative goals in addition to quantitative metrics in our incentive programs and maintenance of equity ownership guidelines. We believe the risks arising from our compensation policies and practices for our employees are not reasonably likely to have a material adverse effect on our company.

Director Compensation – 20202022

Each director who is not a Teleflex employee receives compensation for his or her service as a director, which consists of an annual cash retainer, payable in equal monthly installments, an annual stock option grant, a restricted stock unit award and meeting attendance fees. Our chairman (if he or she is not a Teleflex employee) and theThe chairpersons of our Audit, Compensation and Nominating and Governance Committees receive an additional annual cash retainer, and our Lead Director receives an additional annual restricted stock unit award. In addition, upon their first election or appointment to the Board, non-management directors receive a grant of an option to purchase shares of our common stock.

17

For 2020,2022, the amounts payable under our non-management director compensation program were as follows:

• Annual Cash Retainer – All Non-Management Directors | $ | |||

• Additional Annual Cash Retainer – Committee Chairs: | ||||

¡ Audit Committee Chair | $22,500 | |||

¡ Compensation Committee Chair | $17,500 | |||

¡ Nominating and Governance Committee Chair | $14,000 | |||

• Annual Equity Grants – All Non-Management Directors: | ||||

¡ Restricted Stock Units | $ | |||

¡ Stock Options | $ | |||

• Additional Annual Equity Grant – Lead Director: | ||||

¡ Restricted Stock Units | $40,000 | |||

• Stock Option Grant Upon Initial Election | $ | |||

• Meeting Fees (per meeting): | ||||

¡ Board of Directors (participation in person) | $2,000 | |||

¡ Board of Directors (participation by telephone) | $1,000 | |||

¡ Committees (participation in person or by telephone) | $1,000 | |||

In February 2021,2023, our Board approved changes with respect to certain components of its annual compensation, effective immediately after conclusion of the Annual Meeting. Specifically, the Board approved increases in the annual cash retainer amount, the value of the annual equity awards granted to all non-management directors and the value of stock options granted to non-management directors upon their initial election to the Board. The Board approved these changes after considering the results of a director compensation review undertaken by its compensation consultant, Frederic W. Cook & Co., Inc. The amounts payable under our director compensation program, as revised, are as follows:

• Annual Cash Retainer – All Non-Management Directors | $ | |||

• Additional Annual Cash Retainer – Committee Chairs: | ||||

¡ Audit Committee Chair | $22,500 | |||

¡ Compensation Committee Chair | $17,500 | |||

¡ Nominating and Governance Committee Chair | $14,000 | |||

• Annual Equity Grants – All Non-Management Directors: | ||||

¡ Restricted Stock Units | $ | |||

¡ Stock Options | $ | |||

• Additional Annual Equity Grant – Lead Director: | ||||

¡ Restricted Stock Units | $40,000 | |||

• Stock Option Grant Upon Initial Election | $ | |||

• Meeting Fees (per meeting): | ||||

¡ Board of Directors (participation in person) | $2,000 | |||

¡ Board of Directors (participation by telephone) | $1,000 | |||

¡ Committees (participation in person or by telephone) | $1,000 |

18

The table below summarizes the compensation paid to non-management directors during the fiscal year ended December 31, 2020.2022.

Name | Fees Earned Or Paid in Cash (1) | Stock Awards (2) | Option Awards (3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings (4) | All Other Compensation | Total | Fees Earned Or Paid in Cash (1) | Stock Awards (2) | Option Awards (3) | Change in Nonqualified Deferred Compensation Earnings (4) | All Other Compensation | Total | ||||||||||||||||||||||||||||||||||||

George Babich, Jr. | $ | 87,667 | $ | 174,796 | $ | 86,793 | $ | 393 | – | $ | 349,649 | $ | 118,161 | $ | 147,768 | $ | 74,273 | $ | 223 | – | $ | 340,425 | ||||||||||||||||||||||||||

Candace H. Duncan | $ | 94,667 | $ | 130,247 | $ | 86,793 | – | – | $ | 311,707 | $ | 126,161 | $ | 113,384 | $ | 74,273 | – | – | $ | 313,817 | ||||||||||||||||||||||||||||

Gretchen R. Haggerty | $ | 70,000 | $ | 130,247 | $ | 86,793 | – | – | $ | 287,040 | $ | 99,661 | $ | 113,384 | $ | 74,273 | – | – | $ | 287,317 | ||||||||||||||||||||||||||||

John C. Heinmiller | $ | 69,000 | $ | 130,247 | $ | 86,793 | – | – | $ | 286,040 | $ | 74,250 | $ | 113,384 | $ | 74,273 | – | – | $ | 261,907 | ||||||||||||||||||||||||||||

Stephen K. Klasko | $ | 66,000 | $ | 130,247 | $ | 86,793 | $ | 229 | – | $ | 283,269 | $ | 79,661 | $ | 113,384 | $ | 74,273 | $ | 130 | – | $ | 267,447 | ||||||||||||||||||||||||||

Andrew A. Krakauer | $ | 67,000 | $ | 130,247 | $ | 86,793 | $ | 111 | – | $ | 284,151 | $ | 82,661 | $ | 113,384 | $ | 74,273 | $ | 63 | – | $ | 270,380 | ||||||||||||||||||||||||||

Richard A. Packer | $ | 67,000 | $ | 130,247 | $ | 86,793 | – | – | $ | 284,040 | $ | 22,333 | – | – | – | – | $ | 22,333 | ||||||||||||||||||||||||||||||

Nina M. Patil(6) | $ | 55,333 | $ | 113,384 | $ | 148,469 | – | – | $ | 317,186 | ||||||||||||||||||||||||||||||||||||||

Stuart A. Randle | $ | 85,333 | $ | 130,247 | $ | 86,793 | – | – | $ | 302,373 | $ | 95,661 | $ | 113,384 | $ | 74,273 | – | – | $ | 283,317 | ||||||||||||||||||||||||||||

Benson F. Smith(5) | $ | 54,666 | – | – | $ | 10,258 | – | $ | 64,924 | |||||||||||||||||||||||||||||||||||||||

| (1) | For each of Ms. Duncan, Dr. Klasko and Mr. Krakauer, includes |

| (2) | The amounts shown in this column represent the aggregate grant date fair value of the restricted stock units we granted to each non-employee director in |

| date fair value per share of |

| (3) | The amounts shown in this column represent the aggregate grant date fair value of the stock option awards we granted to each non-employee director in |

| (4) | The amounts shown in this column reflect above-market interest earned in respect of deferred compensation under our Deferred Compensation Plan. |

| (5) | Mr. |

| (6) | Ms. Patil initially was elected as a director on |

Director Stock Ownership Guidelines

We have stock ownership guidelines for our non-management directors to further align the interests of our directors with those of our stockholders. The stock ownership guidelines require our

19

non-management directors to own shares of our common stock with an aggregate value equal to five times the annual cash retainer paid to our directors (exclusive of additional amounts provided to the committee chairs), which, based on the current $55,000$65,000 annual cash retainer, is equal to $275,000.$325,000. Stock ownership value is calculated based on the number of shares owned by the director or members of his or her immediate family residing in the same household and the number of restricted stock units held by the director, including restricted stock units as to which settlement has been deferred under our deferred compensation plan. Shares underlying stock options are not included in calculating stock ownership value. Directors may not sell shares of stock underlying equity awards granted to them in respect of their service on our Board until such time as they have met the required ownership level; provided, however, that, prior to meeting the required ownership level, directors may sell shares to cover the exercise price of stock options and taxes.

As set forth in the table below, atof December 31, 2020,2022, each of our current non-management directors, other than Ms. Patil, who was elected to the Board in April 2022, satisfied the stock ownership requirements.

Name | Stock Ownership Value at 12/31/2020(1) | |||

George Babich, Jr. | $ | 4,667,054 | ||

Candace H. Duncan | $ | 2,279,464 | ||

Gretchen R. Haggerty | $ | 1,759,480 | ||

John C. Heinmiller | $ | 990,099 | ||

Stephen K. Klasko | $ | 6,126,128 | ||

Andrew A. Krakauer | $ | 1,123,828 | ||

Richard A. Packer | $ | 1,450,555 | ||

Stuart A. Randle | $ | 3,614,341 | ||

|

The Audit Committee assists the Board in its oversight of the integrity of Teleflex’s financial statements, Teleflex’s internal control over financial reporting, the performance and independence of Teleflex’s independent registered public accounting firm, the performance of the internal audit function and compliance with legal and regulatory requirements. Management has primary responsibility for preparing Teleflex’s consolidated financial statements and for its financial reporting process. Management also has the responsibility to assess the effectiveness of Teleflex’s internal control over financial reporting. PricewaterhouseCoopers LLP, Teleflex’s independent registered public accounting firm, is responsible for expressing an opinion on (i) whether Teleflex’s financial statements present fairly, in all material respects, its financial position and results of operations in accordance with generally accepted accounting principles and (ii) the effectiveness of Teleflex’s internal control over financial reporting.

In this context, the Audit Committee has:

reviewed and discussed with management and PricewaterhouseCoopers LLP Teleflex’s audited consolidated financial statements for the fiscal year ended December 31, 2020;2022;

discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission; and

received the written disclosures and the letter from PricewaterhouseCoopers LLP regarding PricewaterhouseCoopers LLP’s independence, as required by the applicable requirements of the Public Company Accounting Oversight Board, and has discussed with PricewaterhouseCoopers LLP that firm’s independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, the inclusion of the audited consolidated financial statements in Teleflex’s Annual Report on Form 10-K for the year ended December 31, 2020,2022, for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE | ||||

| CANDACE H. DUNCAN, CHAIR | ||||

GRETCHEN R. HAGGERTY | JOHN C. HEINMILLER | |||

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis describes in general our executive compensation program and also includes a discussion of modifications made to that program with respect to 2020 in connection with the impact of the global pandemic caused by the COVID-19 novel strain of coronavirus that impacted world economic and business conditions generally, and our operations and financial results in particular, during the year. As discussed below, the Compensation Committee of our Board of Directors consulted with its independent compensation consultant regarding the impact of COVID-19 on our executive compensation programs, and concluded that the decisions it ultimately made are generally consistent with similar actions taken by our peer companies and in the market generally, and that such decisions are appropriate to recognize strong performance by our executive officers in the context of the challenges presented by the pandemic.

In this Compensation Discussion and Analysis, we address the compensation paid or awarded to the following current and former executive officers of our company, who are listed in the Summary Compensation Table that follows this discussion and who we refer to as our “named executive officers”officers”:

Name | Title | |

Liam J. Kelly | President and Chief Executive Officer | |

Thomas E. Powell | Executive Vice President and Chief Financial Officer | |

| Corporate Vice President | |

Cameron P. Hicks | Corporate Vice President and Chief Human Resources Officer | |

James P. Winters | Corporate Vice President, Manufacturing and Supply Chain | |

2022 PERFORMANCE HIGHLIGHTS

In October 2020, Mr. Leyden notified2022, global dynamics created a formidable operating environment for the medical device industry. Inflation impacted many world markets, increasing the costs of raw materials and shipping. This was compounded by headwinds from foreign exchange rates. Our industry also continued to experience intermittent supply chain disruptions throughout the year, including issues related to freight, logistics, and the availability of select raw materials and components. Collectively, these pressures challenged us, requiring our team to approach each hurdle with determination and flexibility.

The Teleflex team met these obstacles head-on, continuing to execute our business strategy with diligence and discipline. Our established strength in operations served us well, as we leveraged our global supply chain to align our manufacturing and shipping functions with market shifts, and meet customer demand. We worked to offset cost pressures by seeking new ways to minimize our operating expenses, as well as by employing more targeted pricing strategies. We also maintained our commitment to delivering exceptional quality control across every facet of our business. Our efforts generated excellent results, with the vast majority of our businesses delivering strong performance within an exceptionally challenging environment. At the same time, we continued to advance each tenet of our strategy for durable growth.

Our highlights for 2022 include:

We fueled organic growth, developing and marketing existing products, and investing in product innovation for the future.

We maintained healthy margins by employing pricing strategies, and prioritizing the growth of select high-margin products and sectors.

We optimized our business, expanding in high-growth markets and regions, acquiring Standard Bariatrics, and continuing to execute our restructuring plan.

We continued to invest in clinical education, providing product training to more than 185,000 healthcare professionals around the world.

We advanced our commitment to Corporate Social Responsibility (CSR), including enhancing our Diversity, Equity & Inclusion initiative, and promoting our environmental goals.

21

Our ability to deliver these accomplishments in a turbulent market underscores the value of our past investments in innovation and infrastructure. More importantly, it highlights the extraordinary dedication and resilience of the Teleflex team. In addition, our steady performance during a difficult year highlighted the many strengths that he will retire on March 31, 2021position us for a bright future. Our diversified portfolio helped insulate us from market pressures, our team excelled in meeting customer needs, and our well-designed infrastructure enabled us to pursue a career in public interest. Mr. Leyden served in his role as Corporate Vice President, General Counselmanage changing dynamics and Secretary until December 31, 2020,continue to deploy our strategy. In addition, our strong balance sheet enabled us to maintain our M&A activities and will remain with us through March 31, 2021 as a senior advisor until his retirement date. Daniel V. Logue became our Corporate Vice President, General Counsel and Secretary effective January 1, 2021.pave the way for future growth.

EXECUTIVE COMPENSATION OVERVIEW

Compensation Objectives

Our executive compensation program is designed to promote the achievement of specific annual and long-term goals by our executive management team and to align our executives’ interests with those of our stockholders. In this regard, the components of the compensation program for our executives, including the named executive officers, are intended to meet the following objectives:

Provide compensation that enables us to attract and retain highly skilled executives. We refer to this objective as “competitive compensation.”

Create a compensation structure that in large part is based on the achievement of performance goals. We refer to this objective as “performance incentives.”

Provide long-term incentives to align executive and stockholder interests. We refer to this objective as “stakeholder incentives.”

Provide an incentive for long-term continued employment with us. We refer to this objective as “retention incentives.”

We fashioned the components of our 20202022 executive compensation program to meet these objectives as follows:

Type of Compensation | Objectives Addressed | |

Salary | Competitive Compensation | |

Annual Bonus | Performance Incentives | |

| Competitive Compensation | ||

Equity Incentive Compensation | Stakeholder Incentives | |

| Performance Incentives | ||

| Competitive Compensation | ||

| Retention Incentives | ||

22

Key Compensation Practices and Policies

What we do | What we don’t do | |

• Practice pay-for-performance, under which a significant percentage of our named executive officer compensation is at-risk and subject to achievement of corporate and individual performance goals | • The Compensation Committee’s independent consultant performs no other work for the Company

• We do not guarantee annual bonus or guarantee salary increases

• No excise tax gross-ups for any change in control payments

• Executives are prohibited from hedging or pledging our stock

• Re-pricing of stock options is prohibited without stockholder approval | |

• Set challenging incentive plan goals | ||

• Maintain an industry-specific peer group for benchmarking compensation | ||

• Target named executive officer compensation to be within a competitive range of the median of companies referenced in the comparative data reviewed by the Compensation Committee | ||

• Require our senior executives to satisfy meaningful stock ownership guidelines to strengthen the alignment with our stockholders’ interests | ||

• Maintain a clawback policy that allows us to recover annual and long-term performance-based compensation if we are required to restate our financial results, other than a restatement due to changes in accounting principles or applicable law | ||

• Hold an advisory vote on executive compensation on an annual basis to provide our stockholders with an opportunity to give feedback on our executive compensation program | ||

• Maintain an independent Compensation Committee | ||

• Consult with an independent compensation advisor on compensation levels and practices | ||

Role of Compensation Committee, Chief Executive Officer and Compensation Consultant

The Compensation Committee of the Board is responsible for the oversight of our executive compensation program. In 2020,2022, the Compensation Committee generally made all decisions concerning compensation awarded to the named executive officers other than Mr. Kelly. Determinations concerning Mr. Kelly’s compensation were made by the independent members of the Board. In making these compensation decisions, both the Compensation Committee and the independent members of the Board were assisted by the Compensation Committee’s independent compensation consultant, Frederic W. Cook & Co., Inc., which we refer to as “FW Cook.” FW Cook was engaged directly by the Compensation Committee. The Compensation Committee has assessed the independence of FW Cook pursuant to NYSE rules and concluded that the work of FW Cook has

23

not raised any conflict of interest in connection with its service as an independent consultant to the Compensation Committee.